The backbone of the UK’s economy is its service sectors, encompassing areas such as retail, hospitality, finance, professional services, and business administration.

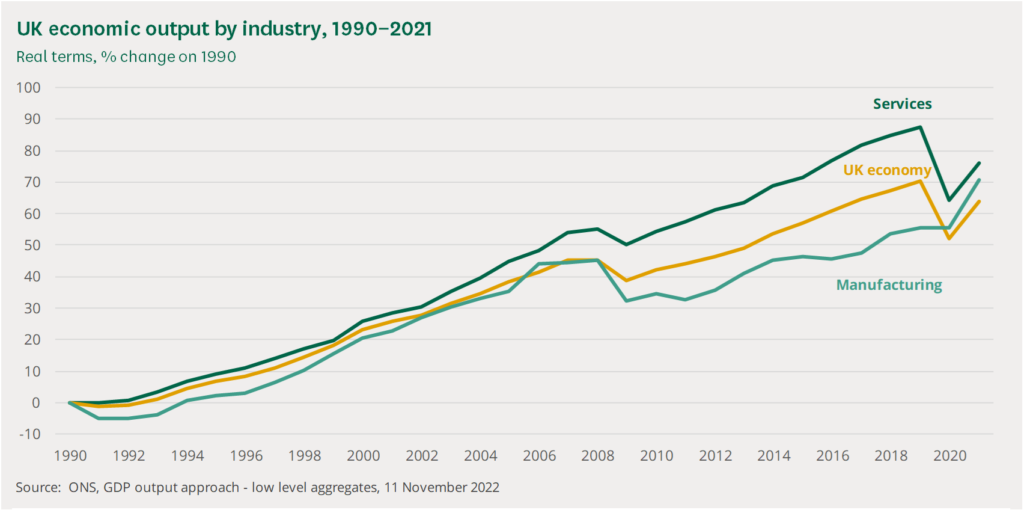

In 2021, these service sectors infused the UK’s economy with a Gross Value Added (GVA) of £1.7 trillion, which forms 80% of the country’s total GVA. GVA, akin to GDP, gives us an understanding of economic output, it captures the net value of services and products, post deducting production costs.

On the other hand, the manufacturing sector’s GVA stood at £204 billion, equating to 10% of the national total. The construction domain recorded an output of £124 billion, forming 6% of the GVA.

For a visual representation of the growth trajectory of services and manufacturing sectors since 1990, please refer to the accompanying chart.

Employment Overview by Industry

The employment landscape at the national echelon mirrors the economic output.

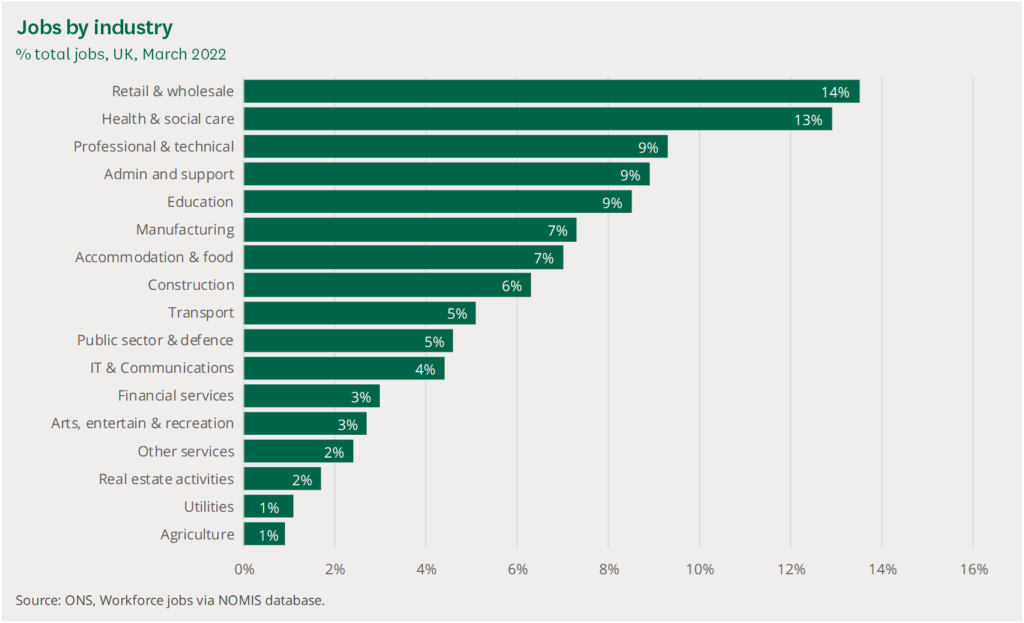

Service sectors were the primary job providers, accounting for 30.0 million jobs as of March 2022, which translates to 84% of the UK’s workforce. Manufacturing sectors propped up 2.6 million jobs, marking 7% of UK employment, whereas the construction realm held 2.3 million positions, equating to 6%. It’s noteworthy that the job figures don’t equate to the actual number of employed individuals, given that a person might have multiple jobs.

For a detailed breakdown of jobs by pivotal industrial sectors as of March 2022, please consult the subsequent chart.

Industry Distribution: Regional and National Overview

The industrial blueprint of the UK’s regions and countries predominantly aligns with the overall UK pattern, but there are some distinctive deviations:

Both Wales and the East Midlands saw the manufacturing sector contribute 17% to their economic output in 2020, a contrast to the UK’s 10% average.

Service sectors in London represented a whopping 93% of its economic contribution, surpassing the national average of 80%.

The industry dynamics in 2020 were heavily influenced by the COVID-19 outbreak, with sectors such as Accommodation & food, Arts, entertainment & recreation, and Other services (inclusive of beauty salons and hairdressers) facing significant setbacks. Unfortunately, regional industry-specific economic output data extends only to 2020.

Source: https://commonslibrary.parliament.uk/research-briefings/cbp-8353/