At its most recent policy meeting, the Bank of England opted to maintain the status quo regarding interest rates, following a string of hikes, in light of diminishing inflation and dwindling prospects for growth.

This Insight scrutinizes the latest trends in inflation and earnings and contemplates the future landscape for economic expansion. It also furnishes a summary of the latest ascensions in GDP data.

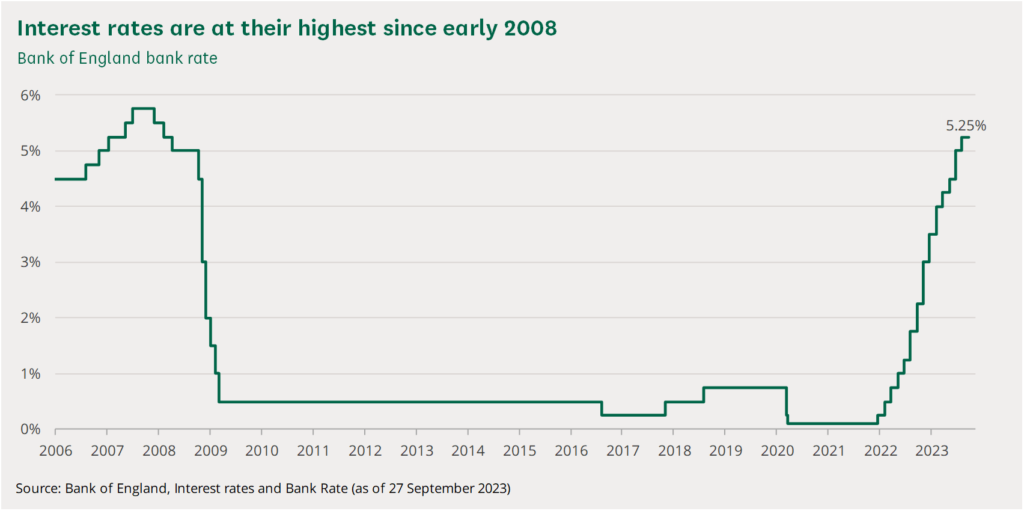

Interest Rates Hold Steady, Attaining a 15-Year Apex

Concluding a series of elevations in interest rates over 14 successive meetings since December 2021 (as illustrated in the chart below), the Bank of England’s Monetary Policy Committee (MPC) chose to stabilize rates in September.

The verdict was narrowly reached, with five members of the MPC favoring the preservation of its benchmark bank rate at 5.25%, while four advocated for a further hike. The internal discussion within the MPC mirrors the prevailing ambiguity regarding the economy and the perspective on inflation.

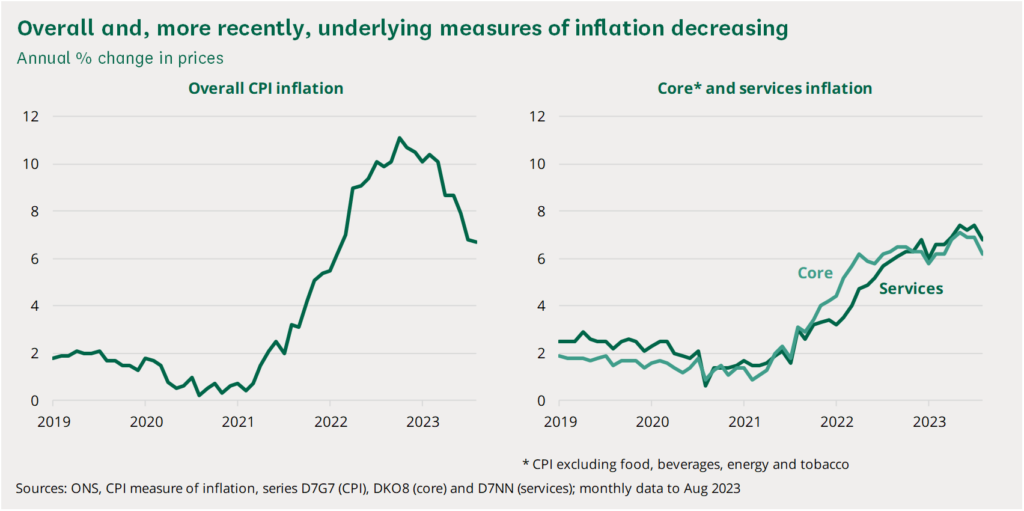

Inflation Experiences a Decline Yet Remains Elevated

The rate of inflation, identified as the yearly alteration in the consumer prices index (CPI), has witnessed a downward trajectory since reaching its zenith at 11.1% in October 2022, settling at 6.7% in August 2023. This implies that while prices continue to ascend, they are doing so at a decelerated pace than previously.

Despite the overall descent in the inflation rate, metrics of intrinsic inflation within the economy saw an upswing in the initial half of 2023. To illustrate, inflation in services recently hit a 31-year pinnacle, registering 7.4%. Inflation related to services, being less susceptible to international events (such as fluctuations in energy costs), is more reliant on internal factors, which include the expansion of wages and consumer demand.

Conversely, the most recent inflation data dispatch from the Office for National Statistics (ONS) indicated a dip in services inflation from 7.4% in July to 6.8% in August. Core inflation, which omits food and energy costs, also experienced a decline, moving from 6.9% to 6.2%. Both of these measures have touched their lowest points since March, as depicted in the chart beneath.

Anticipated Dip in Inflation Rate with a Focus on a 5% Goal by Year’s End

The inflation rate is projected to descend toward 5% as the year concludes, primarily attributed to the absence of the previous year’s steep ascents in energy charges – thereby causing those past augmentations to be excluded from the yearly inflation computation.

Even though inflation is on a downward slope, it markedly surpasses the Bank of England’s 2% objective. Members of the Monetary Policy Committee (MPC) advocating for rate hikes to further mitigate inflation have highlighted the sustained elevation of these foundational inflation markers.

An expanded exploration of inflation is available in the Library briefing concerning the escalating cost of living.

Trends Indicate a Diminishing Heat in the Labour Market

Policymakers are vigilantly monitoring wage growth, as it represents a substantial portion of costs for numerous firms, with a potential part of which may be related to consumers through elevated prices.

Although average compensation has been escalating rapidly, it had, until recently, not been aligning with inflation. The annual wage augmentation, excluding bonuses, reached 7.8% from May to July 2023, a leap from 5.2% during the equivalent timeframe a year earlier and the apex it has reached in decades (excluding the statistically skewed pandemic duration).

Nonetheless, hints are emerging that the erstwhile consistently robust labor market has recently exhibited frailty. Data from the Office for National Statistics (ONS) for May to July 2023, relative to the preceding three-month phase (February to April), revealed:

– An uplift in the unemployment rate from 3.8% to 4.3%

– A diminution in the percentage of individuals aged 16 to 64 in employment from 76.0% to 75.5%

– A sustained drop in the number of job vacancies from historically elevated levels.

A languishing labor market might beget decelerated wage growth and diminished risk of inflation lingering above the MPC’s 2% benchmark.

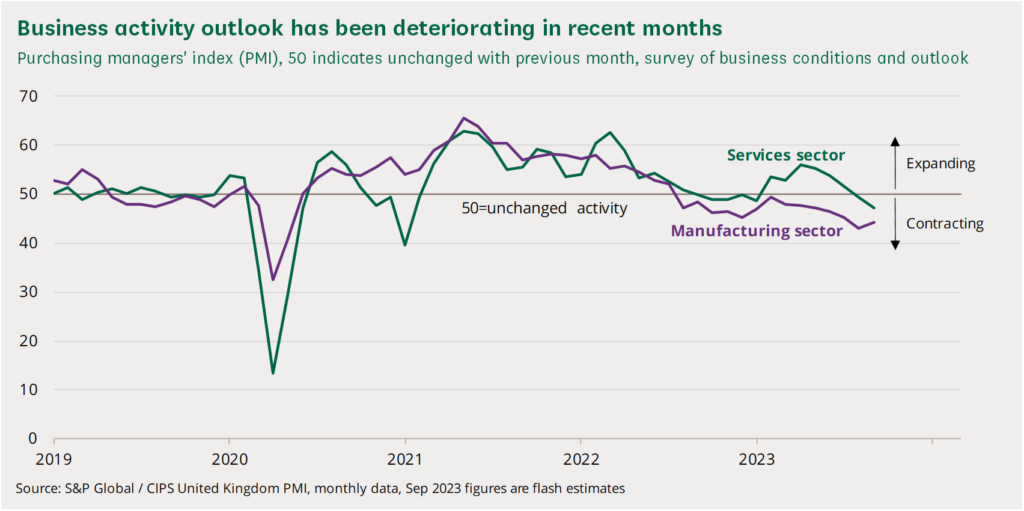

Apprehensions Surrounding Economic Growth Prospects

The strength of economic growth stands as a pivotal factor for the MPC when determining interest rates to govern inflation.

Broadly, a swifter rise in economic activities enhances the likelihood of sustained high inflation. An uptick in interest rates amplifies borrowing costs, curtailing economic growth and inflationary tension. The MPC has observed that preceding rate augmentations “were anticipated to increasingly burden the economy”.

Despite certain variances, GDP has experienced only a slight enhancement since the onset of 2022. Given that the UK is a substantial net importer of energy and food, some speculated that the nation would be engulfed by recession in light of skyrocketing energy and fuel costs. Such a scenario has yet to unfold, with the economy demonstrating resilience.

However, a few recent economic indicators are showcasing signs that economic activity is tapering. For instance, S&P Global’s purchasing managers’ index, a minutely observed indicator of private-sector economic activity, has been diminishing and in September noted its swiftest decline rate since January 2021 (PDF).

MPC Foresees Modest Economic Growth, Adjusting Previous Predictions

The Monetary Policy Committee (MPC) envisions a 0.1% economic expansion during the third quarter of 2023, a figure more conservative than its prior prediction of 0.4% growth, made in August. The inherent growth for the latter half of 2023 is also anticipated to fall short of earlier forecasts.

Upward Revisions to Pandemic-Era GDP Growth

In a concurrent development, the Office for National Statistics (ONS) has communicated that it will be elevating its GDP growth estimates for 2020 and 2021. The revisions are driven primarily by enhanced information gathered from a business survey, focusing on the financial burdens companies encountered throughout the pandemic.

As of the moment of reporting, the updated figures extend only until the conclusion of 2021. The GDP growth for 2020 has been adjusted upwards from -11.0% to -10.4%, and for 2021 from 7.6% to 8.7%. A comprehensive dataset is scheduled for publication by the ONS on 29th September.

Source: https://commonslibrary.parliament.uk/economic-update-have-interest-rates-peaked/