The UK’s economic narrative this month predominantly showcases a stable yet stagnant scenario, with major indicators like GDP exhibiting minimal fluctuations. While the economy, gauged through GDP, has maintained a level trajectory, other variables like inflation and economic inactivity have resisted a decline. Nonetheless, subtle indicators suggest potential shifts are looming, specifically concerning economic inactivity and monetary policy approaches. This Insight delves into the economic figures from April and speculates about forthcoming variations in the near term.

Economic Stability Without Growth Prevails

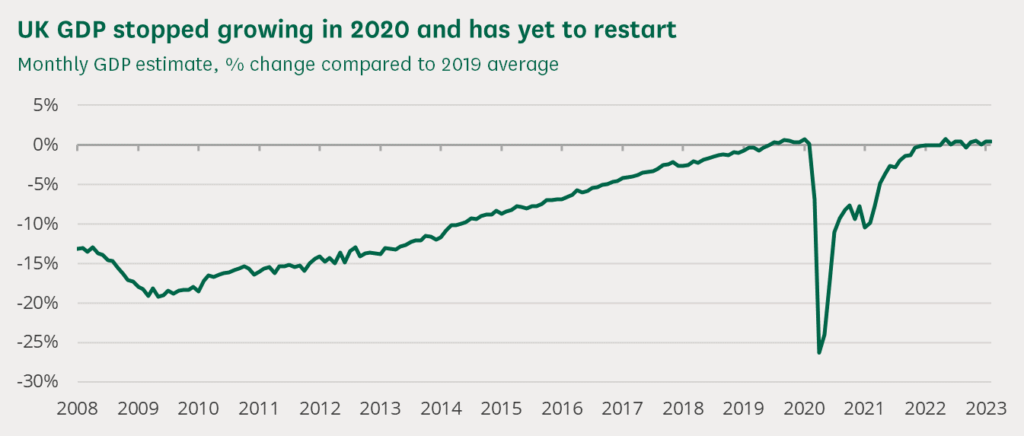

Recent data from the Office for National Statistics (ONS), released on 13 April, indicates that the UK economy while avoiding contraction, is not experiencing growth either. As demonstrated in the subsequent chart, the GDP growth trajectory, interrupted by the COVID-19 pandemic, has not yet resumed, with the estimated figure for February 2023 reflecting zero net growth.

It appears increasingly plausible that the UK’s economy avoided contraction in the initial quarter of 2023, contrary to previous predictions that hinted at a potential shrinkage. In light of the released figures, the Chancellor conveyed optimism, affirming that the UK was “on course to circumvent a recession.”

Nevertheless, the static growth trajectory positions the UK a step behind other leading economies. According to the most recent World Economic Outlook by the International Monetary Fund (IMF), the UK is projected to experience the most diminished GDP growth among the G7 nations in 2023 (-0.3%; with Germany being the sole other G7 country predicted to encounter an economic contraction) and ranks second lowest in 2024 (+1.0%, surpassing Italy’s +0.8%).

Amidst the subdued growth, indications of an uptick in activity across various economic sectors are surfacing. The S&P Global/CIPS Purchasing Managers’ Index, a barometer for business activity, reported growth that surpassed projections in the preliminary estimate for April (PDF). In a similar vein, consumer optimism, as reflected by the GfK Consumer Confidence Index, witnessed a surge, complemented by an increase in retail sales in the three months leading to March 2023, relative to the preceding trimester.

Persistently Elevated Inflation May Trigger Another Rate Hike

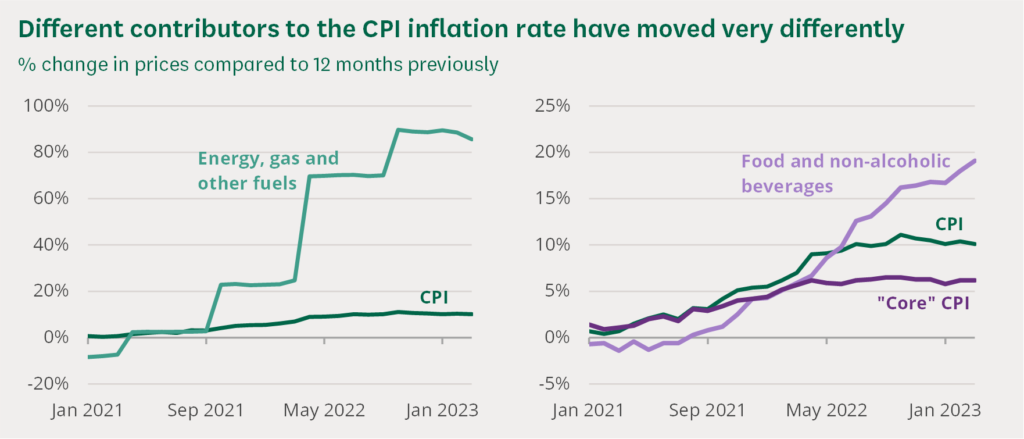

The Consumer Prices Index (CPI) of inflation perpetuated its double-digit stance in March (10.1%), marking its seventh consecutive month. There is a broad expectation that the CPI will commence a downward trend shortly, albeit primarily attributed to the anticipated slower pace of energy price escalation this year compared to 2022. The subsequent chart delineates how energy price inflation is intimately tied to the Ofgem price cap, which has witnessed notably substantial elevations in recent months.

“Core” inflation, which omits items with notably fluctuating prices such as food, energy, and alcohol, was recorded at 6.2% in March 2023, mirroring the rate from April 2022. The cost of food has maintained its steep position, inflation concerning food and non-alcoholic beverages soared to 19.1% in March, speculated to be the peak rate since 1977.

This unrelenting elevation in inflation has led to widespread anticipation that the Bank of England’s Monetary Policy Committee (MPC) will opt to escalate the Bank’s base interest rate once again during its May policy assembly. Should this transpire, it will mark the 12th consecutive increase of the base rate by the committee. Several forecasters, including entities like Capital Economics and ING, suggest that further rate hikes may be less probable, envisioning a potential retraction of the base rate in the forthcoming months.

Chronic Illness Constraints Labour Market Momentum

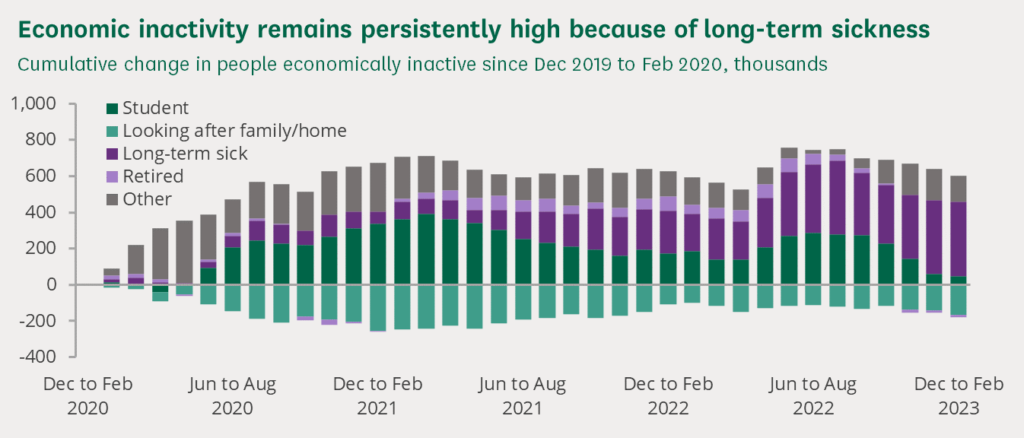

Recent data from the ONS indicates a dip in economic inactivity (pertaining to individuals without employment who are also not seeking it). Both employment and unemployment rates during the period from December 2022 to February 2023 experienced a marginal uptick compared to the prior three months, as individuals who were economically inactive re-engaged with the labour market. As delineated in the chart below, economic inactivity has seen an overarching decrease, attributed to a decline in individuals inactive due to their student status. Conversely, the segment inactive due to long-term sickness has sustained an upward trajectory, presently registering at an unprecedentedly high level (approximately 415,000 above pre-pandemic figures).

While the employment rate has seen a rise, it yet lingers beneath its pre-pandemic level. The Institute for Employment Studies’ labour market statistics reveal that the UK currently stands as the sole major economy experiencing this scenario. The same report posits that individuals in disadvantaged situations might not be partaking in the labour market’s revival, a factor that could potentially be impeding growth.

Source: https://commonslibrary.parliament.uk/economic-update-uk-economy-not-growing-but-not-shrinking/